Course HighlightsCovers Technical Analysis, Candlesticks Analysis, Price PatternsHelps you become a professional in the field of Technical Analysis120 hours of tutorial lecturesLearn from the comfort of your homeHelps you prepare for CMT Level-1 exam

About the Course

Language of Instruction: Telugu, Hindi, English

Course DescriptionCMT is the gold standard in Technical analysis,it is offered by Market Technicians Association(MTA).The Chartered Market Technician (CMT) Program requires candidates to demonstrate proficiency in a broad range of topics in the field of Technical Analysis.The CMT designation demonstrates to clients and potential clients, employers and potential employers, and your colleagues and peers that you are a professional in the field of Technical Analysis.Successful completion of the CMT Level I and CMT Level II exams provides a significant step towards attaining the Registered Research Analyst (Series 86) from FINRA.The CMT designation allows you to separate yourself from other professionals in your industry. It is a perfect complement to your fundamental knowledge of the financial industry.

Who should enroll in this course?

1)Any body who is interested in investing or trading in the financial markets or if someone who likes to start their career as a stock market analyst can take up this course.

2)House wives,retired employees,traders,commodities traders,stock market dealers,brokers,analysts can take up this course

Course Prerequisites:

Pre-requisite is understanding and presentation skills of English language and some basics of internet usage

Note: This course prepares the learners to take up CMT Level-1 exam conducted by MTA

Study Material recommended by MTA for this course:

i)Edwards, Robert D., Magee, John, and Bassetti, W.H.C. Technical Analysis of Stock Trends, 10th Edition5)Study material recommended for this course by MTA is

ii)Kirkpatrick, Charles D. and Dahlquist, Julie R.: Technical Analysis The Complete Resource for Financial Market

iii)Pring, Martin J.: Technical Analysis Explained, 5th Edition

iv)) du Plessis, Jeremy, The Definitive Guide to Point and Figure 2nd Edition

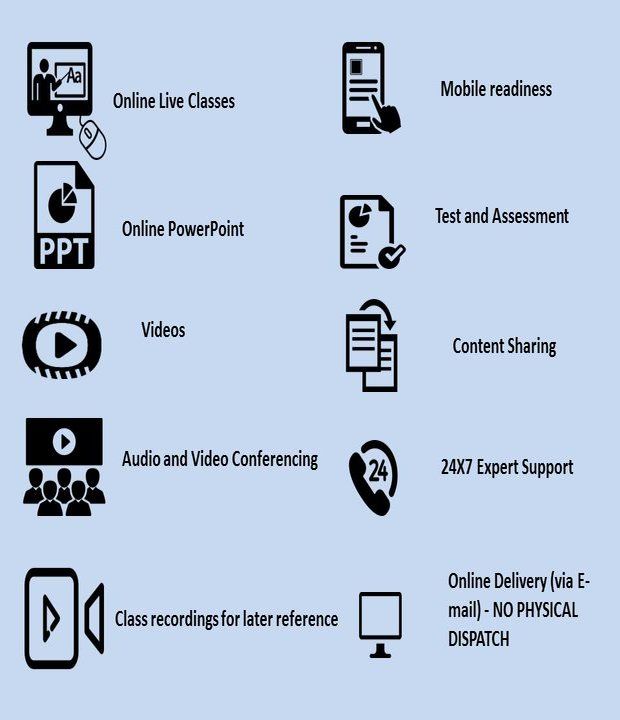

Course PackageMinimum 120 hours of demonstration

200 ppts for presentation

10 assignments

Topics Covered in the course:

The technical approach to trading and investing

Charts

The Dow Theory

The Dow Theorys defects

Important Reversal Patterns

Important Reversal Patterns: continued

Important Reversal Patterns: the Triangles

Important Reversal Patterns: continued

Other Reversal phenomena

Consolidation Formations

Gaps

Support and Resistance

Trendlines and Channels

Major Trendlines

The probable moves of your stocks

What is a bottom, what is a top?

Trendlines in action

Use of Support and Resistance

Not all in one basket

Measuring implications in technical chart patterns

Balanced and diversified

How much capital to use in trading

Application of capital in practice

Portfolio risk management

Introduction to Technical Analysis

The Basic Principle of Technical Analysis The Trend

History of Technical Analysis

The Technical Analysis Controversy

An Overview of Markets

Dow Theory

Measuring Market Strength

Temporal Patterns and Cycles

Flow of Funds

History and Construction of Charts

Trends The Basics

Moving Averages

Bar Chart Patterns17. Short-Term Patterns

Confirmation

Cycles

Elliott, Fibonacci, and Gann

Selection of Markets and Issues: Trading and Investing

System Design and Testing

Money and Risk Management

Appendix A Basic Statistics

Appendix B Types of Orders and Other Trader Terminology

Financial Markets and the Business Cycle

.Dow Theory

Tpical Parameters for Intermediate Trends

Trendlines

Basic Characteristics of Volume

Classic Price Patterns

Smaller Price Patterns and Gaps

One- and Two-Bar Price Patterns

Moving Averages

Momentum I: Basic Principles

Momentum II: Individual Indicators

Momentum III: Individual Indicators

Candlestick Charting

Miscellaneous Techniques for Determining Trends

The Concept of Relative Strength

Price: The Major Averages

Price: Sector Rotation

Time: Cycles and Seasonal Patterns

Practical Identification of Cycles

Volume II: Volume Indicators

Market Breadth

Indicators and Relationships That Measure Confidence

The Importance of Sentiment

Integrating Contrary Opinion and Technical Analysis

Why Interest Rates Affect the Stock Market

Using Technical Analysis to Select Individual Stocks

Technical Analysis of International Stock Markets

Automated Trading Systems

Checkpoints for Identifying Primary Stock Market Peaks and Troughs

Introduction to Point and Figure Charts

Understanding Point and Figure Charts

Projecting Price Targets

Characteristics and Construction

Learn Everything, Anywhere, Anytime

India's Largest Online Education Marketplace